Medicare Basics

Medicare is a federal program created by legislation signed into law by President Lyndon B. Johnson on July 30, 1965. The program was originally designed to provide hospital (commonly referred to as Part A) and medical (Part B) coverage to seniors. In the years since, it has expanded to cover people with disabilities and to allow people to buy additional benefits from private insurance companies in the form of Medicare Advantage, Medicare Supplement/Medigap, and prescription drug plans (Part D).

The following sections are designed to provide a basic understanding of Medicare, but individual needs and circumstances can vary greatly. We encourage you to contact our office with questions specific to your situation.

Contents

What are the “Parts” of Medicare?

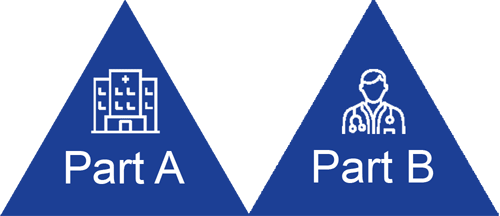

Part A and Part B (Original Medicare)

Medicare Part A is often referred to as “hospital insurance,” and provides coverage for in-patient hospitalizations, care received at a skilled nursing facility, home healthcare (if certain criteria are met), and hospice care.

Medicare Part B is often referred to as “medical insurance,” and covers services provided by doctors and other medical professionals in an out-patient setting, home healthcare (if certain criteria are met), Durable Medicare Equipment (DME), and some preventive services.

Parts A and B are available to people 65 and older, as well as those under 65 with certain disabilities, including End Stage Renal Disease (ESRD) and Amyotrophic Lateral Sclerosis (ALS).

If you are turning 65, you will be automatically enrolled in Parts A and B when you begin collecting Social Security benefits, or benefits from the Railroad Retirement Board. If you elect to delay Social Security, you will not be enrolled automatically. However, you should contact the Social Security Administration to enroll in Part A and/or Part B if you do not have other health insurance, or if you have employer-sponsored health insurance that pays secondary to Medicare. Individuals who have health insurance that pays primary to Medicare may delay enrollment in Parts A and B as long as their coverage is in place, but it’s important to note that a failure to enroll when required can lead to late enrollment penalties that increase the cost of Medicare coverage for as long as you are enrolled.

If you are under 65 and eligible for Medicare due to disability, you will automatically be enrolled in Parts A and B following 24 months of Social Security disability benefits or certain disability benefits from the RRB.

With Original Medicare, you can see any doctor or hospital that accepts Medicare, anywhere in the U.S.

Most people do not have to pay monthly premiums for Medicare Part A, however, there are monthly premiums for Part B. You will also be responsible for deductibles, copayments and/or coinsurance when you receive services.

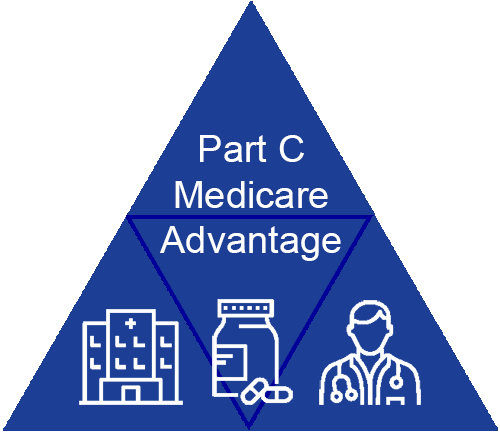

Part C (Medicare Advantage)

Medicare Advantage, sometimes called “Part C,” “MA” or “MAPD,” is another way to obtain Medicare coverage. These plans are provided by Medicare-approved private insurance companies.

If you enroll in a Part C plan, you’ll still need Original Medicare, but you will receive most of your Part A and Part B coverage from your private plan. Medicare Advantage plans generally include additional benefits not covered by Original Medicare, such as dental, vision, and hearing coverage, and some plans reduce out-of-pocket costs for members. Most also provide prescription drug coverage (Part D).

There are a variety of types of Medicare Advantage plans, including Preferred Provider Organization (PPO) plans, Health Maintenance Organization (HMO) plans, and HMO Point-of-Service (HMO-POS) plans, among others. Each type of plan has its own advantages and limitations, largely related to provider networks, the availability of care outside a network, and referral requirements.

If you enroll in a Part C plan, you’ll be required to pay monthly premiums for both your Original Medicare (in most cases, just Part B), as well as your Medicare Advantage Plan—though there are Medicare Advantage plans available without a monthly premium. You will also be responsible for deductibles, copayments and/or coinsurance when you receive services.

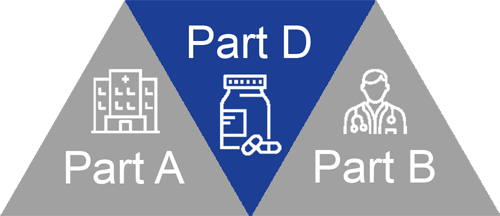

Part D (Prescription Drug Coverage)

Medicare Part D is an optional benefit that covers prescription drugs. Part D prescription drug plans, sometimes called PDPs, are available from private insurance companies, and can be purchased in addition to Part A, Part B, and Medicare Supplement plans. Most Medicare Advantage plans include Part D prescription drug coverage.

While you are not required to purchase a Part D plan, it is best to do so when you are first eligible if you do not have creditable drug coverage from another source, such as an employer-sponsored group health plan. If you wait to enroll in Part D, and have not had creditable prescription coverage for the duration of your eligibility for Part D, you will likely pay a late enrollment penalty for as long as you have Medicare prescription drug coverage.

The prescription drugs covered by Part D plans can vary from one plan to another. When evaluating options, it is important to verify that any medications you take are covered in the plan’s formulary or drug list.

If you enroll in a Part D plan, you will be required to pay monthly premiums for your prescription drug coverage, in addition to the premiums of any other Medicare coverages you have elected. Your out-of-pocket costs for prescriptions will vary based on whether you use brand or generic drugs, and throughout the year as you progress the Part D coverage stages—Deductible, Initial Coverage Period, Coverage Gap/Donut Hole, and Catastrophic.

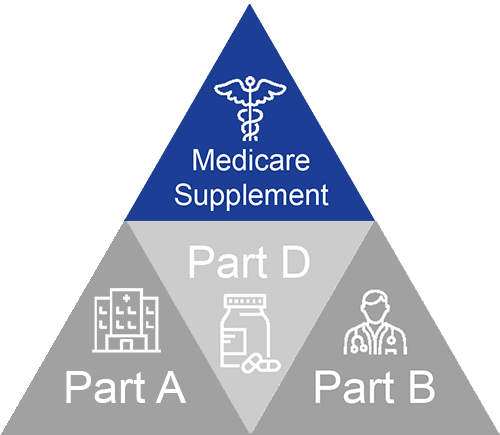

Medicare Supplement

Medicare Supplement plans, often called Medigap or Supplemental plans, are not technically one of the “parts” of Medicare, but can be purchased in addition to Original Medicare. These plans are offered by private insurance companies, and cover some of the costs of care not paid by Medicare, such as deductibles, coinsurance, and copayments.

You must be enrolled in Medicare Parts A and B to enroll in a Medicare Supplement plan.

Medicare Supplement plans are “standardized” by state and federal regulations, and are identified in most states by letters A through D, F, G, and K through N. Within any state, plans of the same letter offer the same benefits, regardless of the insurance company that offers them. However, some plans may include benefits in addition to those standardized, and costs can vary from one insurer to another.

You may purchase a Medicare Part D prescription drug plan in addition to Supplement coverage (as long as your Supplement policy does not include this coverage).

If you enroll in a Medicare Supplement plan, you will be required to pay monthly premiums, in addition to the premiums of any other Medicare coverages you have elected.

When can I enroll?

When you turn 65

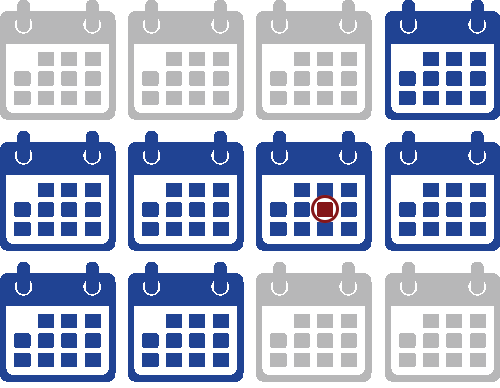

There is a seven-month window around your 65th birthday known as the Initial Enrollment Period. This encompasses the three months prior to your birthday, the month of your birthday, and the three months following your birthday.

During your Initial Enrollment Period, you can enroll in Medicare Part A and Part B, as well as Medicare Advantage (Part C) plans, Medicare Supplement plans, and/or Part D prescription drug plans.

The date your coverage will begin depends on when during your Initial Enrollment Period you enroll.

Should you miss your Initial Enrollment Period, you can enroll in free Medicare Part A at any time. If you are required to pay a Part A premium, you can enroll in it and/or Part B during the General Enrollment Period, January 1 through March 31 each year (coverage effective July 1), but you may incur late enrollment penalties.

You can elect Medicare Advantage and/or Part D prescription drug plans during the Annual Election Period, October 15 through December 7.

You can enroll in a Medicare Supplement plan at any time during the year, but outside your Initial Enrollment Period, you may be required to answer medical questions that can impact your premium costs.

If you are working and have health insurance through your employer when you turn 65, or if you are covered on your spouse’s health plan, you may not need to enroll in Medicare when you turn 65. However, there are factors you should consider to avoid late enrollment penalties. See the next section for details.

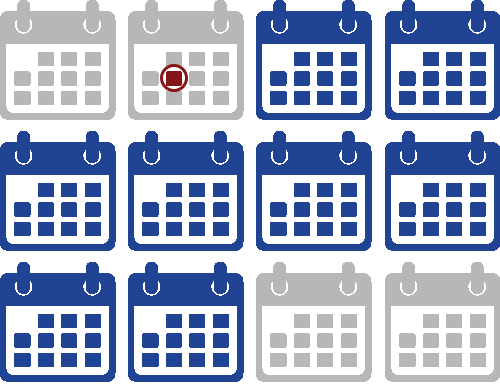

When you retire or if you lose employer coverage

If you are working and have health insurance through your employer when you turn 65, or if you are covered on your spouse’s health plan, you may decide to delay enrolling in Medicare Part A and/or Part B to avoid paying premiums. This is acceptable, so long as your health plan pays primary to Medicare, and you have creditable drug coverage (as good or better than Part D). If this is not the case, you could be assessed late enrollment penalties when you decide to enroll in Medicare.

If your coverage is primary and creditable, and you decide to delay Medicare enrollment in favor of an employer-sponsored health plan, you may decide to enroll in Medicare at any time. Should you retire or lose your employer coverage, you will have eight months beginning the month following your loss of coverage to enroll in Medicare without a penalty.

Being new to Medicare Parts A and B, or a loss of coverage constitutes a Special Enrollment Period, and during this time period, you may also elect Medicare Advantage or Medicare Supplement coverage, as well as a Part D prescription drug plan.

Special Circumstances

If you are under 65 and have a disability, you will automatically get Medicare Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board (RRB) for 24 months.

If you have Amyotrophic Lateral Sclerosis (ALS) you’ll get Parts A and B automatically the month your Social Security disability benefits begin.

If you have End-Stage Renal Disease (ESRD) and you want Medicare, you will need to contact the Social Security Administration to enroll.

While you are new to Medicare Parts A and B, within the first six months of coverage, you may elect to enroll Medicare Advantage or Medicare Supplement coverage, as well as a Part D prescription drug plan.

Can I change plans?

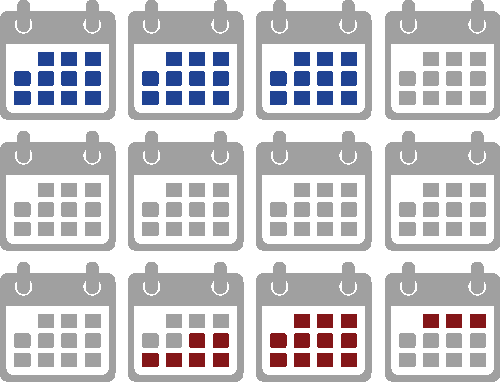

Regular enrollment periods

If you are enrolled in a Medicare Advantage or Part D prescription drug plan, you can change plans during the Annual Election Period that occurs between October 15 and December 7 each year.

If necessary, you can also make a one-time “like plan” change during the Medicare Advantage Open Enrollment Period, January 1 through March 31 each year. This means the plan you switch to must have the same types of benefits as your current plan—from medical and prescription drugs to medical and prescription drugs, or medical-only to medical-only.

If you are enrolled in a Medicare Supplement plan, you can change plans at any time, however, you may be required to answer medical questions and pay higher rates if you do not qualify for a Special Enrollment Period. See the next section for details.

Special Circumstances

When enrolled in a Medicare Advantage, Medicare Supplement, and/or Part D prescription drug plan, you may be eligible to change plans in certain situations that qualify for a Special Enrollment Period. These include moving out of your current plan’s service area, moving in or out of a care facility, a loss of coverage, and other changes in eligibility.

If you believe you have experienced or will experience an event qualifying you for a Special Enrollment Period, we encourage you to contact an Action Senior Benefits expert to evaluate your unique situation and options.

Want personalized help?

We can help you:- Learn about your options

- Find the right plan

or